Manager Selection Process

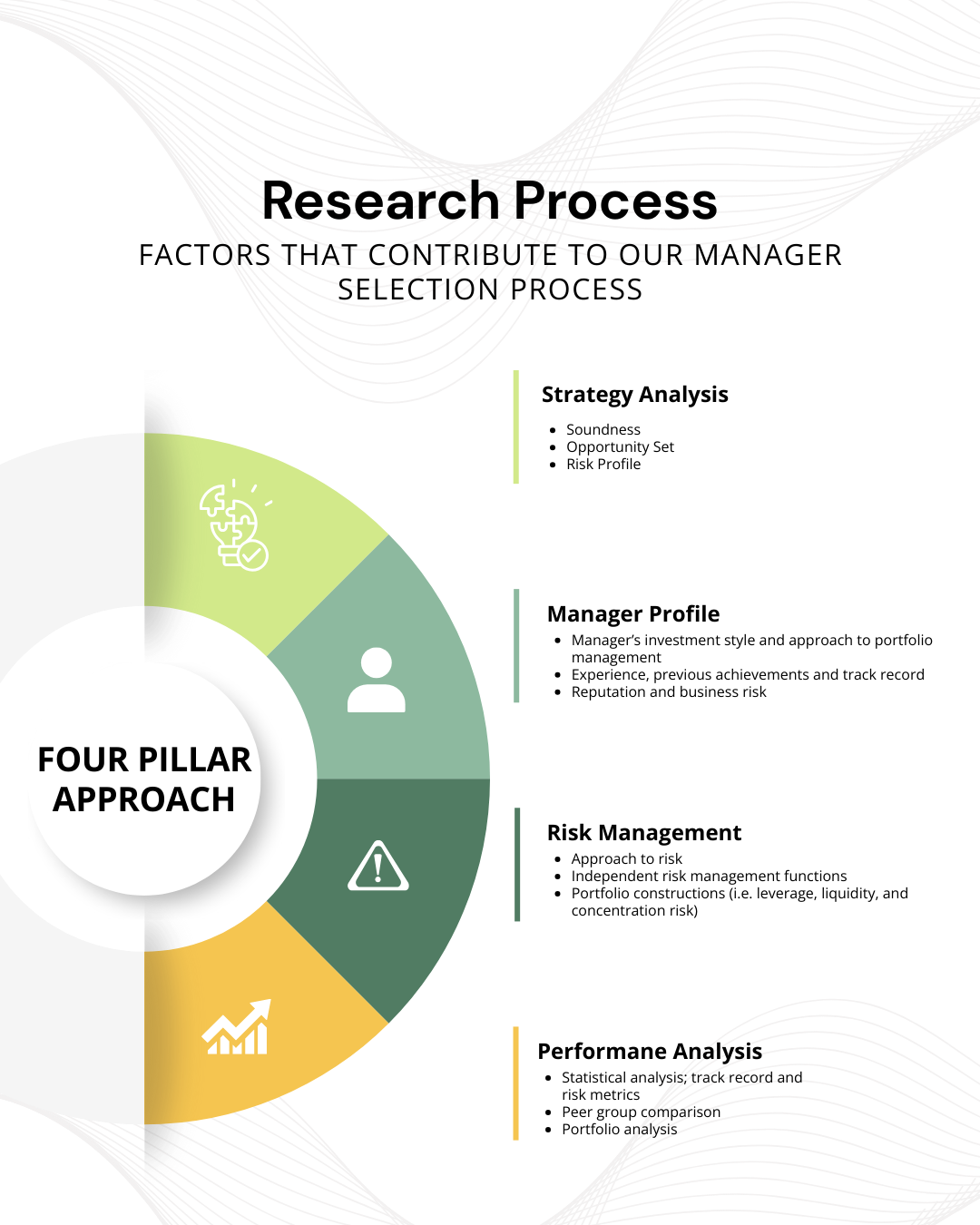

At TGADF, risk is not an afterthought, it is the core of our investment philosophy and the foundation of our manager selection framework.

Every prospective manager is evaluated through a rigorous, multi-stage process that emphasizes durability, discipline, and demonstrated edge. Once a manager is identified as a potential fit, we monitor, analyze, and track their performance, behavior, and decision-making over an extended period.

Our selection criteria typically include:

LP Allocations:

We invest in managers who demonstrate proven, risk-adjusted returns and a repeatable, data-driven edge. Ideal allocation candidates bring:

Quantitative discipline and robust performance metrics

An established fund with 2+ years of trading history, audits, and <$100M in AUM

We selectively allocate to managers with demonstrated alpha generation, typically supported by a Sharpe ratio above 1.1 and a Sortino ratio above 1.8. Candidates must show a disciplined, repeatable process and a defensible edge in their strategy.

Institutional-grade processes and risk management

Clear differentiation from traditional or crowded strategies

Ready for scale

GP Seeding:

We partner with innovative managers ready to scale. Ideal seeding candidates bring:

Unique strategy design with expansion potential

Proven trading record and ready to launch your official fund

Operational maturity or willingness to adopt institutional frameworks

Founder-led alignment and a path to commercial growthTGADF sources opportunities through a deep, global network built over years of industry relationships. From this universe, we screen and evaluate 500+ managers annually, narrowing the field to only those who demonstrate consistent alpha generation, robust risk controls, and alignment with TGADF’s investment principles.

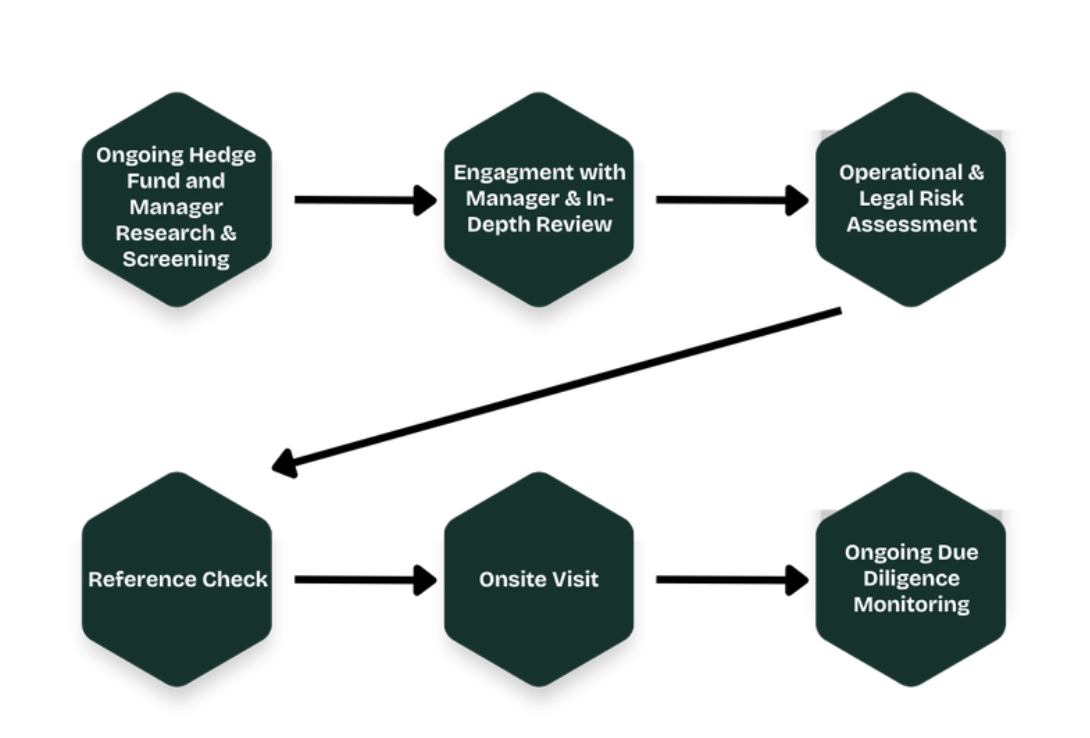

Once a prospective manager enters our pipeline, the due-diligence process begins, a disciplined, long-term observational cycle that incorporates both quantitative and qualitative factors to determine true investability and fit for the portfolio.

Quantitative Evaluation

We leverage our quantitative expertise and proprietary analytics to evaluate and assemble a portfolio of uncorrelated, high-conviction trading strategies.

-

Has the manager delivered consistent performance across the full track record?

-

Are returns attractive relative to drawdowns, volatility, and tail risk?

-

Does the strategy generate positive results when core institutional assets struggle?

-

Do correlations confirm dependence on a distinctive market inefficiency?

-

Has the strategy proven itself through multiple market cycles and environments?

-

Does the payoff structure offer asymmetric upside versus downside exposure?

Qualitative Evaluation

Beyond numbers, we assess the mindset, discipline, and operational readiness required for performance longevity.

-

Can the manager clearly articulate the inefficiency being exploited, and why it should persist?

-

Are the infrastructure, controls, and processes in place to extract alpha reliably at scale?

-

Does the manager have the passion and depth of expertise to adapt and evolve?

-

How do they respond when the market presents the unexpected?

-

Will they maintain discipline through inevitable drawdowns?

-

Can they avoid style drift and ego-driven risk as AUM expands?

The Result

A concentrated portfolio of elite emerging managers with the skill, structural advantage, and operational integrity to generate uncorrelated alpha, not just in strong markets, but when it’s needed most.

At TGADF, we believe that the true value a hedge fund contributes to a portfolio is directly tied to the manager’s unique skill set, domain expertise, and ability to extract returns from diverse, often uncorrelated, sources of opportunity.

Manager skill is the differentiator that drives dispersion within and across strategies, which is why selecting the right manager is far more important than selecting the “right” strategy on its own. Even in challenging or adverse market environments, a highly skilled manager can protect capital and, in many cases, generate positive returns.

Because manager skill is the primary engine of alpha, fund selection is one of the most critical components of the TGADF investment process.

Research, Screening & Monitoring

Our approach begins with deep, sustained research. TGADF conducts comprehensive analysis and ongoing monitoring of managers over extended periods, allowing us to understand not only performance but behavior, consistency, and decision-making under different market conditions.

On-Site Visits

We conduct global, in-person due-diligence visits with every manager in consideration. These visits allow us to verify:

Front-office and investment team structure

Back-office processes and operational robustness

Technology and systems infrastructure

Governance, culture, and workflow alignment

Due Diligence Questionnaires

Our DDQs are tailored to each specific strategy and place particular emphasis on operational integrity. Areas of focus include:

Operational risk assessment

Risk management framework

Internal controls and oversight

Liquidity review

Portfolio pricing and valuation practices

Consistency, independence, and methodology

Audited financial statements

Verification of auditor quality and reporting discipline

Background and reference checks

Key investment and operational personnel

Information flow and transparency

Timeliness, accuracy, and completeness of reporting

Legal Risk Review

TGADF performs a thorough legal assessment that includes:

Detailed review of offering documents and marketing materials

Regulatory checks

Internal evaluation of latent strategy-specific legal risks

Ongoing Monitoring

Once allocated, managers remain under continuous oversight. Our monitoring framework includes:

Monthly update calls and ongoing communication

Regular portfolio reviews

Monthly and quarterly transparency assessments

Tracking of exposures, performance drivers, and risk trends